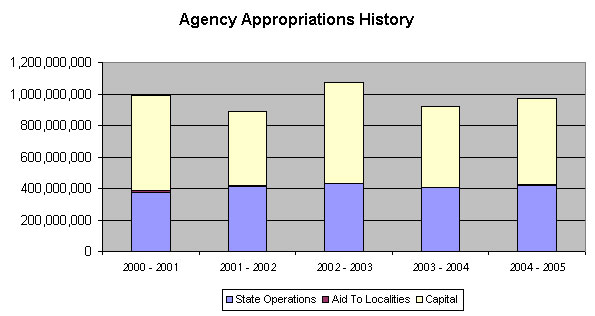

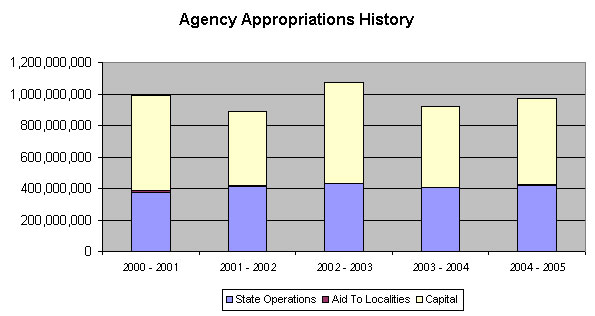

* 2000-01 through 2002-03 reflect enacted appropriations.

* 2000-01 through 2002-03 reflect enacted appropriations.* 2003-04 and 2004-05 reflect Executive recommended appropriations.

| 2004 Yellow Book | |||||

| Backward | Forward | Cover | Overview | Agency Summaries | Agency Details |

|

DEPARTMENT OF ENVIRONMENTAL CONSERVATION (Summary) View Details |

|

|

|||||

|

Adjusted Appropriation 2003-04 |

Executive Request 2004-05 |

Change |

Percent Change |

||

|

|

|||||

|

|

|||||

| AGENCY SUMMARY | |||||

|

|

|||||

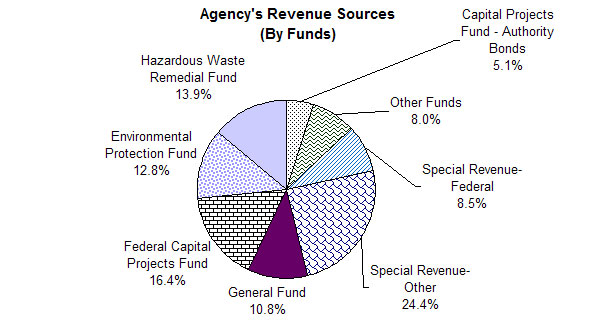

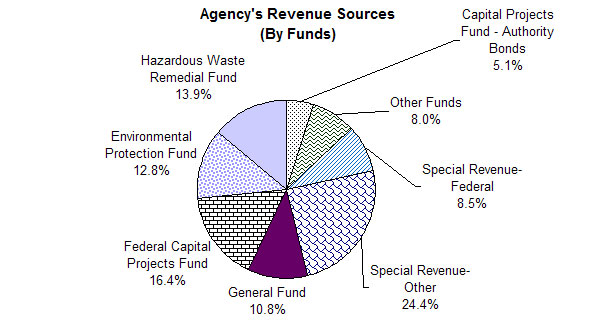

| General Fund | 103,746,000 | 105,424,700 | 1,678,700 | 1.6% | |

| Special Revenue-Other | 216,956,800 | 237,283,000 | 20,326,200 | 9.4% | |

| Special Revenue-Federal | 86,928,000 | 83,018,000 | (3,910,000) | -4.5% | |

| Capital Projects Fund | 38,692,000 | 45,062,000 | 6,370,000 | 16.5% | |

| Capital Projects Fund - Advances | 0 | 30,000,000 | 30,000,000 | -- | |

| Federal Capital Projects Fund | 156,770,000 | 160,114,000 | 3,344,000 | 2.1% | |

| Clean Water-Clean Air Implementation Fund | 2,527,000 | 2,527,000 | 0 | 0.0% | |

| Environmental Protection Fund | 125,000,000 | 125,000,000 | 0 | 0.0% | |

| Hazardous Waste Remedial Fund | 135,000,000 | 135,000,000 | 0 | 0.0% | |

| Capital Projects Fund - EQBA (Bondable) | 991,000 | 327,000 | (664,000) | -67.0% | |

| Capital Projects Fund - Authority Bonds | 51,174,000 | 49,622,000 | (1,552,000) | -3.0% | |

| Internal Service Fund | 45,000 | 45,000 | 0 | 0.0% | |

|

|

|||||

| Total for AGENCY SUMMARY: | 917,829,800 | 973,422,700 | 55,592,900 | 6.1% | |

* 2000-01 through 2002-03 reflect enacted appropriations.

* 2000-01 through 2002-03 reflect enacted appropriations.* 2003-04 and 2004-05 reflect Executive recommended appropriations. |

|

|

|

|

|||

|

ALL FUNDS PERSONNEL BUDGETED FILL LEVELS |

|||

| Fund |

Current 2003-04 |

Requested 2004-05 |

Change |

|

|

|||

|

|

|||

| General Fund: | 1,124 | 1,120 | (4) |

| All Other Funds: | 2,202 | 2,225 | 23 |

|

|

|||

| TOTAL: | 3,326 | 3,345 | 19 |

|

|

| Budget Highlights | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

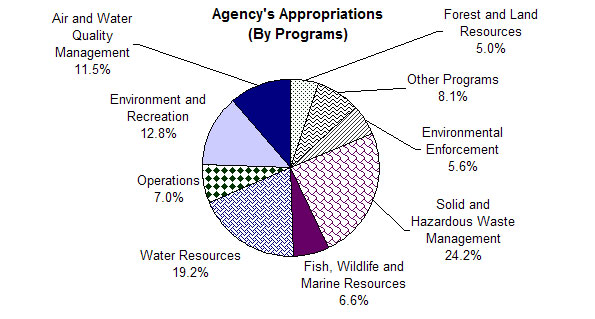

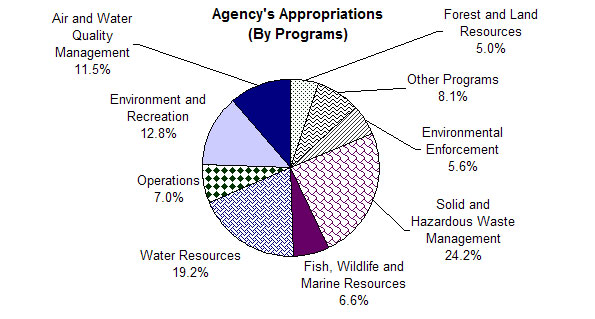

The Department of Environmental Conservation (DEC) is responsible for conserving and improving the State’s natural resources and environment, as well as controlling water, land and air pollution, to enhance the health, safety and general welfare of New York State’s residents. DEC responsibilities also include administering the State’s Environmental Protection Fund (EPF) and the Clean Water/Clean Air Bond Act of 1996. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Department is included in the Transportation, Economic Development and Environmental Conservation Appropriation Bill. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive proposes an All Funds appropriation of $973,422,700, a net increase of $55,592,900 above adjusted levels for State Fiscal Year (SFY) 2003-04. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

State Operations |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive proposes 3,345 full-time equivalent (FTE) positions in SFY 2004-05, a net increase of 19 positions above SFY 2003-04 levels. Sixteen positions would be eliminated due to projected federal aid reductions. Personal service costs for four additional positions would be transferred to the Environmental Enforcement Account. In SFY 2004-05 the Executive proposes to add 35 positions to assist in implementing the new Superfund/Brownfields legislation enacted in 2003-04. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive proposes State Operations General Fund appropriations totaling $99,653,900 for SFY 2004-05. This represents a $2,474,100 net decrease in funding from SFY 2003-04. This decrease would be attributable to: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive recommends State Operations Special Revenue Other appropriations totaling $237,283,000, a net increase of $20,326,200, or 9.4 percent. The increase is attributable to the following: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Governor also proposes a State Operations Special Revenue Federal Fund appropriation of $83,018,000 in SFY 2004-05, which represents a decrease of $3,910,000, or approximately 4.5 percent from SFY 2003-04. This decrease would be attributable to the following federal environmental aid changes: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Waste Tire Management Program |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive proposes an appropriation of $18,000,000 from the Waste Tire Management and Recycling Account, which was created as part of the 2003-04 Enacted Budget to reduce existing scrap tire stockpiles and develop in-State markets for recycling stockpiled, and newly generated, waste tires. The Governor proposes to transfer $40,300,000 in revenues from the Account to the General Fund for general budget relief. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive also proposes to expand the per tire fee which finances the Program to include new tires sold for motorcycles, limited use vehicles, and all-terrain vehicles. It is anticipated that this action would result in $300,000 in revenue in SFY 2004-05, and $575,000 on a full annual basis. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Aid To Localities |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive proposes total Local Assistance funding of $5,770,800 in SFY 2004-05, a net increase of $4,152,800. The increase would be attributed to the following actions: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

All Terrain Vehicle Projects |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive proposes a new All-Terrain Vehicle (ATV) Trail Development and Maintenance Program through Article VII legislation. Part of the proposal includes an increase in registration fees on ATV’s from $10 to $45, which the Executive estimates would result in $5,800,000 in annual revenue based on an estimated 166,700 ATV registrations. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Governor proposes an appropriation of $850,000 from the General Fund to support ATV trail development, enforcement and education. Grants would be made available to municipalities and not-for-profit ATV associations, as well as for municipal and State law enforcement, and DEC program administration. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Capital Projects |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive recommends $547,652,000 in Capital Projects Fund appropriations for SFY 2004-05, an increase of $37,498,000 over SFY 2003-04. This net increase is the result of the following changes: |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Superfund/Brownfields Programs |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive proposes funding of $135,000,000 for the State Superfund and Brownfields Cleanup Programs. This amount is equivalent to the amount provided for in SFY 2003-04, and includes $120,000,000 for the State Superfund and $15,000,000 for costs related to the Brownfield Cleanup Program, including Brownfield Opportunity Area grants, and technical assistance grants for citizen participation. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive estimates $68,000,000 in disbursements for Superfund projects and staff support in SFY 2004-05 from the $120,000,000 proposed appropriation and reappropriation of funds provided in SFY 2003-04. In addition, the Executive estimates $15,000,000 in disbursements for the Brownfields program, and an additional $60 million in disbursements on Superfund projects supported by reappropriations of funding provided under the 1986 Environmental Quality Bond Act. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Environmental Protection Fund |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive recommends appropriations totaling $125,000,000 from the Environmental Protection Fund (EPF) for SFY 2004-05. The Governor proposes these appropriations as lump-sum amounts for each of the accounts within the EPF which, if enacted, would provide no statutory guidance on the allocation of funds to be spent on each EPF category. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In addition, the Executive proposes numerous new project categories and amendments to the EPF statute. The Executive's proposed allocations for the EPF include $26,200,000 in cost shifts and the addition of new purposes. In addition, the Executive proposes to sweep $10,000,000 in cash from the EPF for General Fund relief. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Although the appropriations are presented as lump-sums, the Governor maintains that in SFY 2004-05, the EPF would be allocated as follows (categories in italics are new programs and/or offloads): |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Article VII |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

The Executive proposes Article VII legislation that would:

|

|

|

|||||

| Backward | Forward | Cover | Overview | Agency Summaries | Agency Details |

|

New York State Assembly [Welcome] [Reports] |