LEGISLATURE ENACTS SWEEPING ETHICS REFORM

The Legislature significantly reformed New York law regulating the conduct of public officials. The new law:

Creates an independent Joint Commission on Public Ethics, for the first time authorizing a single body to investigate the legislature, executive branch and lobbyists.

Revises disclosure requirements and, for the first time, requires officials to disclose the names and income earned from their clients with state business.

Creates a public database listing firms representing those with State business.

Expands the definition of “lobbying” to make it more comprehensive.

Increases penalties for violations of campaign finance laws.

Creates a review commission to assess the effectiveness of the new law.

ABINANTI SEEKS REAL RELIEF FOR PROPERTY TAX PAYERS

Abinanti joined 10 other Majority members to support a proposed amendment on the Assembly floor in an unsuccessful effort to cut Westchester County’s property tax-funded mandated contribution to the State Medicaid Program.

Abinanti sponsored legislation to phase out the county share of the cost of Medicaid and legislation to limit the increase in pension costs paid by local governments and school districts. A majority of the Westchester delegation support both measures.

NEW YORK PASSES LANDMARK MARRIAGE EQUALITY LAW

With a historic and bipartisan vote in both the Assembly and Senate, New York joined Connecticut, Iowa, Massachusetts, New Hampshire, Vermont, and the District of Columbia to become the largest state to legalize same-sex marriage.

The Marriage Equality Law ensures that all married couples have the same basic legal rights with respect to property ownership, health care, hospital visitation, taxation, insurance coverage, child custody, pension benefits, inheritance, testimonial privileges, and societal recognition of their love and commitment.

ABINANTI SUPPORTS “MILLIONAIRES’ TAX”

New York State’s high income tax surcharge expires December 31, 2011. The surcharge applies to individual’s income over $250,000 and families’ income over $300,000 a year.

Continuing the tax until the end of the fiscal year, March 31, 2012, would produce $1.1 billion—about the same as the cut to education in this year’s budget.

Abinanti and the Assembly support a true “Millionaires’ Tax,” a surcharge on income over $1 million, which would bring in $4 billion a year.

Without a “Millionaires’ Tax,” New York’s wealthiest 1% will be taxed in the same tax bracket as individuals earning $20,000 and families of four earning $40,000 a year—giving each New York millionaire a tax break of at least $85,000 a year. This is in addition to Federal tax cuts for America’s wealthiest, who on average will get over $128,000 annually from Bush administration tax cuts for at least the next two years.

ASSEMBLY BETTERS BAD BUDGET

In his first state budget, Assemblyman Abinanti worked with other legislators to pass an on-time budget with no new taxes. The Assembly faced a $10 billion deficit and a constitution that empowers the Governor to force the Legislature to pass the Executive Budget as is or shut down State government. The Executive Budget proposed drastic cuts. The Assembly significantly improved the proposed Executive Budget to restore critical funds and ease the pain to Westchester. The Assembly successfully fought for education, health care, and other vital programs. Had there been political will to continue the income tax surcharge on those earning more than $1 million, many cuts would have been avoided.

EDUCATION

The Executive Budget proposed cutting hundreds of millions of dollars and shifting more special education costs to local school districts. The Assembly forced the Governor and the Senate to add back $272 million. The final budget decreased education spending by $1.3 billion, of which $698 million (including $608 million federal monies) was a reduction of state aid to school districts. More importantly for Westchester, the Assembly prevented the proposed shift of special education costs to local school district property taxes.

HEALTH CARE

At the urging of the Assembly, the final budget included important restorations and reforms to improve the quality and accessibility of health care while controlling costs:

More Medicaid patients will access health care through managed care programs.

No increase in Medicaid and Family Health Plus co-payments.

Restorations included: EPIC for low-income Medicare enrollees ($22 million), Early Intervention programs ($5.5 million), and school-based health centers ($21.7 million).

LIBRARIES

The Executive Budget proposed cutting aid to libraries 10% from 2010/11 levels. The Legislature restored 3.6% to the final budget.

FIRST-TIME HOME BUYERS

The legislature approved a new law that allows municipalities to continue the tax exemption for first-time buyers on a newly constructed home.

HIGHER EDUCATION

Budget-related, but in a separate bill, the Legislature continued financial support for the SUNY/CUNY system, stabilized tuition increases and created tuition credits for TAP recipients.

GOVERNMENT OPERATIONS

The Assembly fought to end disproportionate cuts to the state’s environmental agencies. The final budget merged various agencies and public authorities ($50 million savings), cut state work force ($450 million savings), eliminated 3,700 prison beds (savings unknown) and reduced aid to municipalities by 2%.

LEVER VOTING MACHINES

At the urging of Assemblyman Abinanti and other suburban legislators, the legislature passed a new law which authorized villages to continue using lever voting machines in village elections for another year. While current state law requires electronic voting machines, the cost and unavailability of these machines posed a problem for a number of suburban villages.

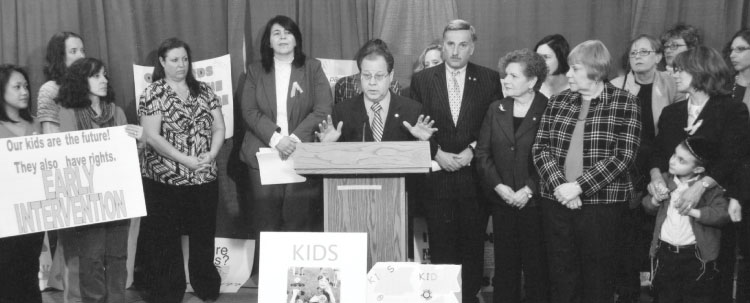

PROTECTING PEOPLE WITH DISABILITIES

AUTISM INSURANCE

After several years of effort by state legislators and advocates for people with autism, this year, the legislature enacted two new laws enhancing requirements that health insurers pay for treatments for people with autism.

The first requires coverage for screening, diagnosis, and treatment for people with autism spectrum disorders. Insurers must cover a variety of treatments that have proven effective, including behavioral, pharmacy, psychiatric, psychological, therapeutic, and other medical treatments provided by a licensed physician. This new law builds on a 2006 law which prohibited health insurers from denying medical service coverage solely because of an autism diagnosis.

The second new law provides better mechanisms for counties to recover reimbursements from health insurers for these services which the counties provide through county early intervention programs.

Autism is the fastest growing disabling disorder, affecting some 1 in 90 children. Absent adequate health insurance coverage, the families of those with autism bear a disproportionate cost and often do not have the resources to provide adequate treatment.

ABUSE AND NEGLECT

Following a series of statewide public hearings that examined and documented allegations of abuse and neglect in group homes and institutions, the Assembly passed a comprehensive package to improve safety in facilities licensed by the Office for People With Developmental Disabilities (OPWDD) that:

Creates a prior-abuse notification system to prevent employees with a history of abuse from working with patients.

Requires mandatory immediate reporting of violent crimes.

Requires standardized training for providers.

Ensures that abuse and neglect investigations continue even after an employee has resigned or been fired.

Requires OPWDD to make at least three unannounced visits and authorizes commissioner-approved independent monitor inspections.

Limits the work week for direct-care workers to less than 60 hours during a seven-day work week except in cases of extraordinary emergencies.