Assemblymember Rivera Joins Local Business Leaders to Call for Support for Legislation That Will Increase Employee Transportation Options

Bill A1486 would allow employees to use pre-tax earnings for the purchase of qualified transportation benefits, empowering those who rely on alternative transportation

Buffalo, NY – Assemblymember Jon D. Rivera today joined with business leaders and alternative transportation advocates to call for broad support for bill A1486, which would authorize any employer to offer employees the opportunity to use pre-tax earnings for the purchase of qualified transportation benefits.

The benefits of the proposed legislation are wide-ranging. Employers would be able to reduce payroll taxes by offering commuter benefits while also making their workplace more attractive to potential employees.

With transportation costs continuing to rise, employees stand to save significantly by using pre-tax income to cover their daily commute expenses. Furthermore, this policy would align the rest of the state more closely with New York City's commuter benefits program, which has been in place since 2016.

This bill represents a significant step forward in supporting workers’ transportation needs, boosting employee retention, and aligning state policy with progressive transportation benefits seen elsewhere.

Every year, employees use a variety of means of transportation to commute to work. Typically, those costs are paid for out of pocket by the employee and those costs are subject to applicable taxes.

Assemblymember Rivera’s bill would allow employers to offer pretax commuter benefits to employees for any transportation in a commuter highway vehicle between the employee's residence and place of employment, any transit pass, qualified parking, bicycle purchase or repair, as well as rideshares.

Rivera’s call for support of the bill follows last year’s release of “Expanding and Retaining Talent: Employer-led Strategies for Transportation and a More Inclusive Workforce” – the 8th brief in a series produced by Goodwill of Western New York, in partnership with the University at Buffalo Regional Institute (UBRI), focusing on transportation challenges faced by Western New York workers who do not own a vehicle.

Transportation has been a persistent challenge in WNY for decades, limiting residents’ access to training, employment and economic mobility. Limited transportation options hinder employers’ ability to attract a wider and more diverse talent pool, particularly in growing sectors like manufacturing and tech.

According to the report, a typical manufacturing and tech company in the Buffalo-Niagara region would have access to 18,710 additional workers if the transportation gap in WNY was closed.

Those without a vehicle earn $20,400 less per year, on average, and are six times more likely to live in poverty. They are more than twice as likely to commute 90 minutes or more per day, and they have access to a third fewer jobs.

The report specifically mentions the efficacy of a commuter benefits initiative. Commuter benefit contributions are pre-tax dollars that an employee sets aside to pay for work-related commuting expenses. These benefits can be used to pay for transit passes, parking fees, ride-sharing costs, and more. A portion of an employee’s paycheck is deposited into a commuter benefits account before taxes are deducted.

Not only do employees save money on their taxes, but such initiatives give companies a cost-effective way to recruit and retain talent.

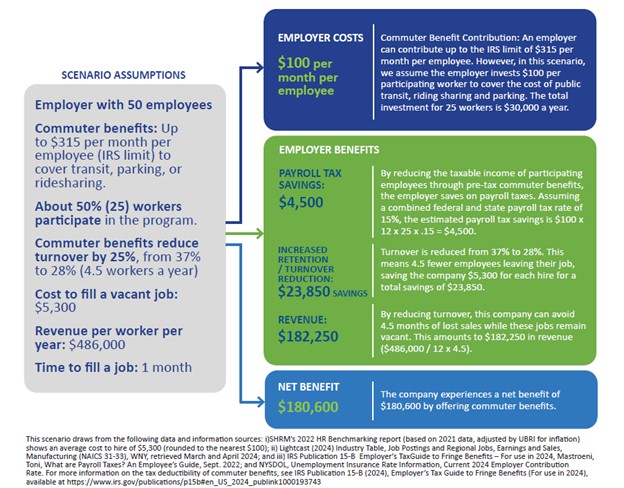

To illustrate the point, the report offers a hypothetical scenario in which an employer invests $100 per worker to cover the cost of public transit, riding sharing and parking.

By reducing the taxable income of participating employees through pre-tax commuter benefits, the employer saves on payroll taxes, and they also reduce the company’s turnover rate by offering financial incentives for their employees to commute.

By reducing turnover, the company avoids 4.5 months of lost sales while these jobs remain vacant, and experiences a significant net benefit in revenue by offering commuter benefits.