Hawley Touts Remedy to Ease Pain at the Pump

Assembly minority unveils plan to reduce fuel costs

Assemblyman Steve Hawley (R,I,C-Batavia) was joined today by his Assembly minority colleagues to introduce a new two-part plan to ease the burden of escalating fuel and energy costs. In it, the Assembly minority renews its call for a gasoline sales tax cap for any amount above $2.00 per gallon and introduces the “Alternative Fuel Incentive Fund” to promote the research, development, and use of alternative energy such as ethanol and bio-diesel.

On April 11, an amendment to provide a sales tax exemption on motor and diesel fuel costing over $2.00 per gallon was defeated 77-64, with 77 majority members voting to defeat it. The minority says they will force another vote for the cap which will save motorists about $.10 per gallon.

“It is unconscionable that there are legislators in this house who are unwilling to help New Yorkers and businesses relieve the pressure they are feeling at the gas pump,” said Hawley. “Our conference is fighting for New Yorkers who have become victims of skyrocketing gas prices.”

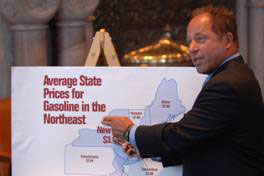

New Yorkers are paying $.65 for seven different taxes per gallon of gasoline, the highest rate in the Northeast. New York State is one of only a handful of states to subject gasoline to sales tax. “It is a tax on top of all the other taxes, and that is not only excessive but it is unfair,” said Hawley.

The sales tax is the only tax that is pegged to the full price per gallon, meaning that as motorists struggle to pay for higher fuel costs, the state reaps a windfall. Hawley believes the windfall the state is bringing in should be returned to motorists. “That money is not part of any budget projection,” he said. “It’s simply extra revenue the state is receiving and it ought to be given back to the people of this state, after all, it’s their money.”

The Assembly minority also proposed accelerating the state’s transition away from a fossil fuel transportation economy to one that is more reliant on alternative and renewable energy sources, a move that will lower fuel costs by lessening the demand for gasoline. The Assembly minority is proposing to place the state sales tax revenue generated from the second dollar of gas into the Alternative Fuel Incentive Fund. It is estimated that the proposal would generate $265 million annually to provide tax credits, grants, investments, and other incentives to encourage ownership of hybrid and flex-fuel vehicles and the building of alternative fueling stations and refineries.

Part of the $265 million includes $20 million for the construction of a cellulosic ethanol refinery in Medina, in Orleans County, part of the 139th Assembly District that Hawley represents. “The refinery is an important part of ending our addiction to foreign oil,” he said. “This is the kind of innovation and technology that our conference is promoting and believes is vital to our transition away from a fossil fuel based economy.”

The Alternative Fuel Incentive Fund also includes tax credits of $500 per hybrid or “flex-fuel” vehicle purchased. To increase fuelling stations for alternative fuels, the program also dedicates $90 million to fund an allocated credit for the installation or conversion of fuelling stations for alternative fuels.

Hawley believes that the initiative introduced today offers short-term and long-term solutions to the problem. “We have to eliminate the sales tax immediately,” he said. “The summer travel months are right around the corner and parents should not be forced to tell their children that we can not go to Darien Lake because we cannot afford the gasoline to get there.”

“With no end in sight to the rising prices, how much longer do we have to wait until somebody says, enough is enough?” Hawley questioned. “Our conference is standing up and saying that the time is now to begin to look to the future with meaningful ideas and programs to end the pain we are feeling at the pump and end our addiction to foreign oil.”